The B-Word. Few words in the English language conjure up more squirminess than the word “budget”. It’s no shocker then that more than two-thirds of Americans don’t even attempt to create a budget (let alone use) to make informed financial decisions.

Budgeting does require planning, time, determination, and some basic math …which can be painful at first for some of us (math legit makes my brain cells hurt.) However, these obstacles disappear when budgeting is seen through a different lens.

Create A Budget You’ll Actually Use in 5 Minutes or Less (Even if You Hate Budgeting)

For most people, when their brain processes the word budget, their minds begin painting pictures of deprivation, depression, agony, restriction, and pain.

It’s the same psychological response one has upon hearing the word diet. Studies have shown that diets can work on the short-term but they aren’t a long-term solution, as human beings aren’t mentally designed to live in a never-ending famine.

People have essentially equated budgets with scarcity and suffering so it’s understandable why they’re less than thrilled to try one out.

Because of all this emotional and psychological baggage, most people have with budgeting, we’re going to back into this concept from a new angle. By approaching this topic from a different way our hope is to cut through preconceived notions, make the process enjoyable, and increase your chances of successful implementation throughout your lifetime.

So, what is the key to creating a successful budget (even when you hate budgeting)?

This shift is massively important to make in your mind…so listen closely.

Once you see a budget simply as permission to spend your money in the ways you want, the budget becomes a tool of empowerment instead of slavery.

All of a sudden your budget is not the straight-jacket preventing you from living, it’s the key to unlocking your financial goals. (Cue heavenly angelic singing!)

A budget is simply a tool that gives your money a job based on the goals you’re aiming to hit at that given moment.

Let’s look at a couple ways this can play out:

Pretend you’re saving up for a splurge trip to Hawaii with your family and you’re trying to allocate as much of your paycheck as possible towards that trip. That means you’ll say “no” to bigger spending in other areas of your budget (movies, clothes, restaurants) because you have a deeper “yes’ for your trip.

Or let’s say you’re trying to pay off all your student loans as fast as humanly possible because you want true financial freedom and no payments hogging your income. That means you will tell your money to hit your students loans hard but you choose to fund other categories less for a season until your goal is hit.

By decidedly limiting some budget areas you have the freedom to nail your goals in other areas.

There’s no strong-arming or deprivation.

It’s purposeful action taken by you as you tell your money how it can best work for you and your goals at that moment in time.

That’s all there is to it and when it’s explained like that – who wouldn’t want to budget? ?

However, it’s one thing to convince you that budgeting is the bee’s knees…but it’s a whole other ball game to help you create an effective budget you’ll actually use.

But that’s exactly what we want to help you do.

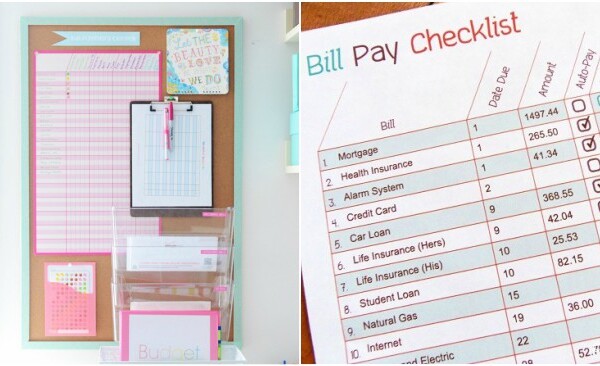

That’s why we created a simple and free step-by-step budget guide infographic.

Inside, you’ll discover how to create a budget you love in under five minutes or less – how’s that sound?

Once you learn the process of how to budget, you’ll be amazed at how quickly it can bolster your confidence and momentum towards financial goals.

0