When it comes to saving money, the earlier one can start, the better. When I was little, money was one of those taboo topics better left to adult conversations. Parents didn’t often give their children money management tips. But things have definitely changed since I was a wee little one. Parents are starting to realize the importance of early money management skills. Transitioning into our teen years, we started to realize the value and importance of having money. Needing gas money to be able to drive all those cool places that we needed to visit…buying clothes, or going out with friends…all those things cost money. While some kids do work growing up, a lot are able to ask for money from their parents, never truly learning the importance of spending habits and how to respect the value of the dollar. Then, comes adulthood.

For those of us who grew up in a household where we learned about the value of money, the transition was probably a little bit easier. We knew the basic rule of money: You have to have more coming in than going out, to stay out of debt in life. But, what about those people who had no experience in managing their own money and budgets? For them, their transitions into adulthood likely weren’t as easy.

Related Post: If you ever plan to gift money to your loved ones, then try these amazing money gift ideas.

Money Management Tips and Financial Habits to Start

Looking back, it’s easy to see the importance of learning to save, plan and budget. It helped to shape our financial knowledge for our future and instilled the ability to understand and respect the value of a hard-earned dollar. With what you know now about saving money, what money management tips would you tell yourself in your 20’s to help prepare you more for your future? For me, the tips are clear. Here are 10 Money Management Tips to Start in your 20’s:

- Start a savings account. Don’t worry about the balance. Just save and forget, each and every month. Make that account untouchable unless truly needed for an emergency. Make yourself put in an amount each and every month or paycheck. Then, make certain to only look at it every once in a while to see its growth. If you can, automate it to add a few bucks from each and every paycheck. That way, you truly can save and forget about it.

- Set a goal. What are you wanting to put your money towards? A home, a car, to pay off loans? Whatever the choice, choose it and set a time-frame to achieve it.

- Search for sales. If you love to shop, it doesn’t have to be an issue. Just shop wisely. At the stores, check out the clearance aisles first or ask for coupon discounts.

- Shop around for cheaper car insurance. Many people don’t know that not all car insurance quotes aren’t created equal. Don’t settle, shop around. There is money to be saved!

- Cut the ties of depending on your parents for money. While it may be convenient and nice to have your parents offer money, cut the ties. Being an adult in your 20’s means that you are capable of managing yourself, your decisions and your finances.

- Pay yourself first. Always give yourself a budget and stick to it. Use your money as you want, but within reason. Life isn’t fun if you have money and can’t use it, but that use should also be responsible and able to cover the needs in life first, before the wants.

- Plan for your retirement. I get it. You literally just started your career and you’re already expected to start planning for the end of it? Yes. It’s more about saving than anything, but have a plan in place to at least be ABLE to retire with an income saved that you can live comfortably on.

- Just say no sometimes. It’s tempting to go out and socialize every night of the week, but that adds up quick. Your money will drain fast and leave you nothing to show for those hours spent out on the town.

- Cut up those credit cards. They can cause a lot of pain and stress. Don’t use them unless absolutely needed.

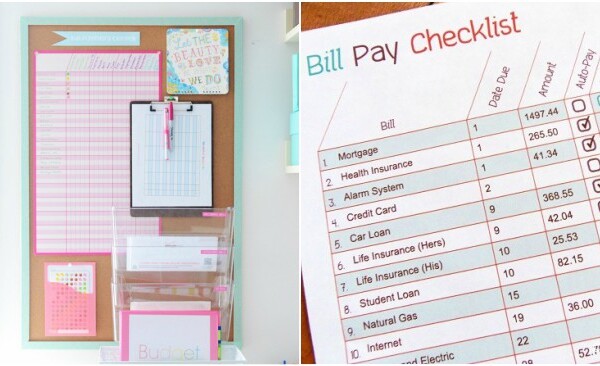

- Work on building up a great credit score. Credit scores actually do matter. If you ever want to take out a loan, rent an apartment or need to borrow money, your credit score can determine the type of APR you get or whether you are approved or denied. Always pay your bills on time, and make sure your debt-to-income ratio is appropriate.

Creating a Strong Foundation Using these Money Management Tips

These 10 money saving tips are perfect for those entering into adulthood for the first time. Creating good financial habits can be hard, but totally possible. Setting a strong foundation when one is young is key as it then gives time to implement, build, grow, and maintain those financial skills throughout the duration of their life.

0